31+ ideal mortgage to income ratio

Compare Offers Side by Side with LendingTree. Your front-end or household ratio would be 1800 7000 026 or 26.

Image4 Jpg

Ad Get the Right Housing Loan for Your Needs.

. Explore Quotes from Top Lenders All in One Place. Comparisons Trusted by 55000000. Web An ideal debt-to-income ratio therefore is any percentage that falls below 36 to err on the side of caution.

Gross monthly income of 6500 x 31 2015 can be applied to. Its not a loan its a home equity agreement. Web How Does DTI Debt to Income Ratio Impact Mortgage Rates Asked by.

Get Instantly Matched With Your Ideal Mortgage Lender. The rule says that no more than 28 of your gross monthly income. An investment of 10000 in each of the three stocks discussed here will allow shareholders to earn 1375 in monthly dividend.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Web The ideal debt-to-income ratio should not exceed 36 of your gross monthly income. That is the highest ratio allowed by large lenders unless they.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web The Ideal Debt-to-Income Ratio. Web Multiply your gross annual income by 28 percent 028 and then divide the result by 12 months to get the maximum amount for your monthly mortgage.

Web Typically in the case of a mortgage your debt-to-income ratio must be no higher than 43 to qualify. Web Say your monthly gross income is 7000 and your housing expenses are 1800. Web What Is an Ideal Debt-To-Income Ratio.

Web Gross monthly income of 6500 x 45 2925 can be applied to recurring debt plus housing expenses. Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA. Kaela Ryan As a general guideline 43 is the highest DTI ratio a borrower can have.

Find out how debt-to-income ratio works and what yours should be at if. Web 40 minutes agoThe Foolish takeaway. As a rule the lower your DTI the better for you.

Ad 10 Best House Loan Lenders Compared Reviewed. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

And yours is coming 33 which is absolutely within the range. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Its not a loan its a home equity agreement.

It takes 41 of the median Colorado income to make the monthly mortgage on the median-priced home. Save Real Money Today. Web What is the maximum debt-to-income ratio for mortgages.

Lenders prefer to see a debt-to. Ad Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value. Ad Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value.

In general 43 is the maximum debt-to-income ratio that mortgage lenders accept. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. These figures may vary slightly based on one lender to.

Begin Your Loan Search Right Here. Taxes insurance mortgage insurance etc divided by gross monthly income. Lock Your Rate Today.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad Calculate Your Payment with 0 Down. - Experian There is no perfect DTI ratio that all lenders require.

To get the back. Ad Easier Qualification And Low Rates With Government Backed Security. Web 1 day agoIncome-to-mortgage ratio among US.

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

How Much Of My Income Should Go Towards A Mortgage Payment

Can I Afford To Buy A Home Mortgage Affordability Calculator

The Top Startups Of 2022 Wellfound Formerly Angellist Talent

How Much Should My Mortgage Be Compared To My Income

9 Best Property Management Companies In Tampa Fl 2023

How Much House Can You Afford Calculator Cnet Cnet

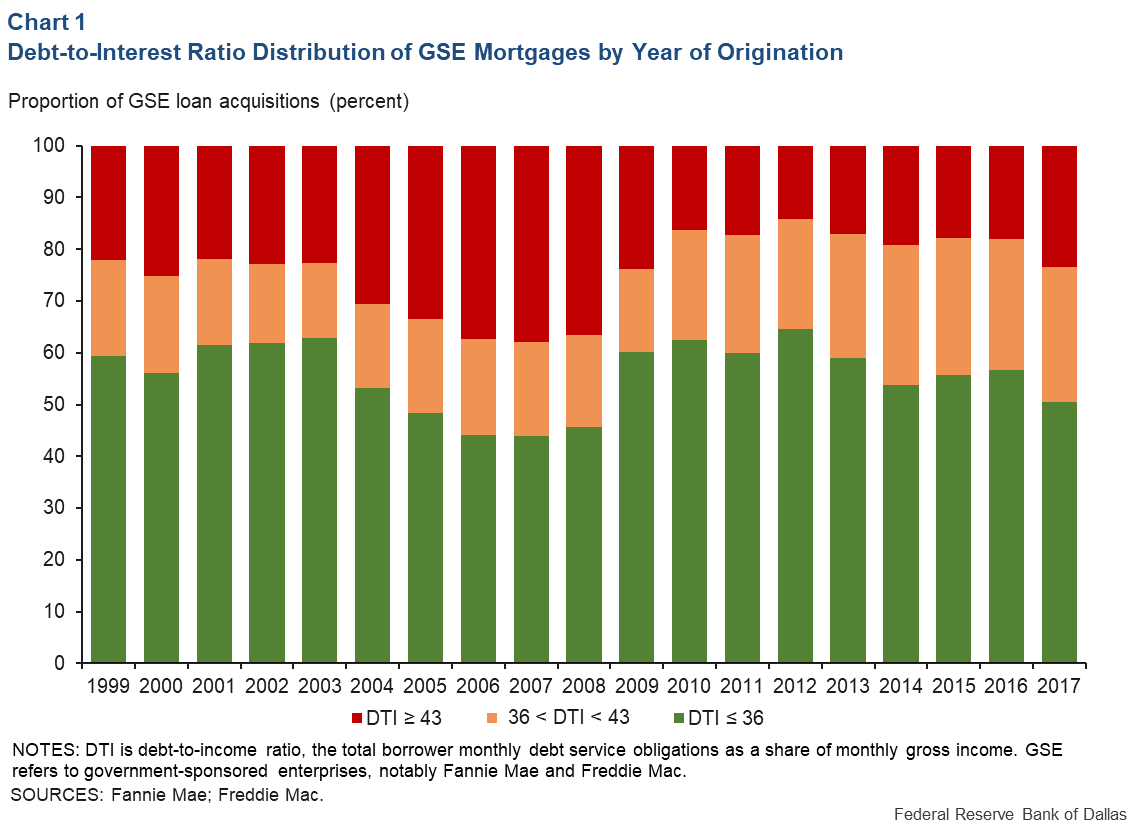

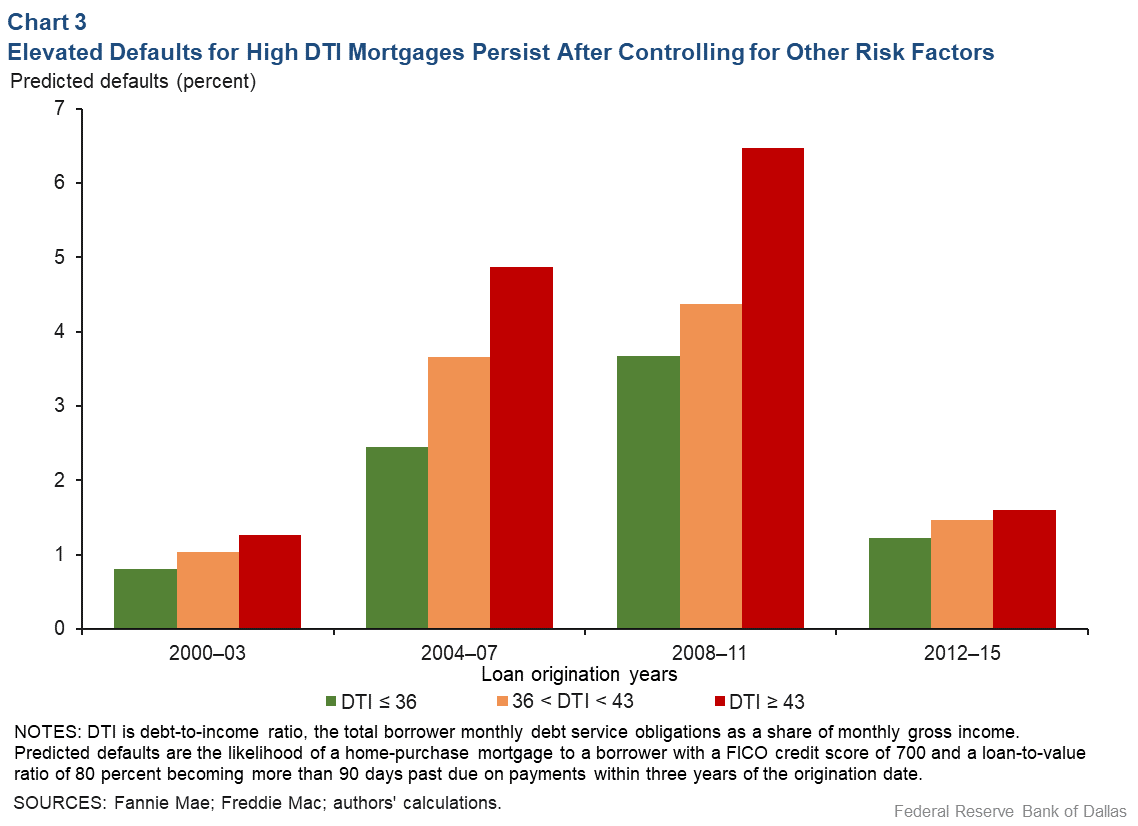

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

How Much Of My Income Should Go Towards A Mortgage Payment

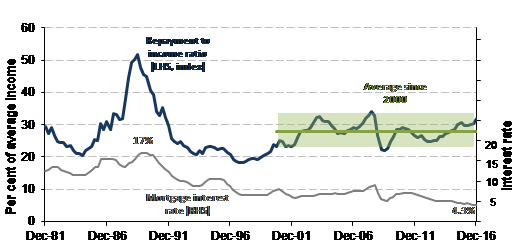

Understanding Housing Affordability Openforum Openforum

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

A Picture More Misleading Than A Thousand Words John Burns Real Estate Consulting

Image11 Jpg

This Is The Average American Homebuyer In 2017 The Motley Fool

India News August 16 31 2022 Vol 3 Issue 3 By India News Issuu

Mortgage Income Calculator Nerdwallet

31 Ways To Save For Halloween Sofi